Shopify Payments: The Shopify payment methods at a glance

One last step and it's done. The payment process is the last instance at which customers can cancel their purchase. That's why there should be no nasty surprises waiting for your customers here. According to a survey by Statista, 59% of online consumers abandon their purchases if they are not satisfied with the payment methods offered. That's why Shopify Payments should cover all common payment methods wherever possible. But what exactly is behind Shopify Payments, what are the advantages and disadvantages and what are the alternatives? This is exactly what I would like to share my experiences with you.

What is Shopify Payments?

Shopify Payments is an integrated payment processing solution offered by Shopify. It allows merchants to accept payments directly through their Shopify stores without having to rely on external third-party payment gateways. All payments can be easily managed from one dashboard. Through Shopify Payments, customers can securely pay with the following payment methods:

Klarna: Purchase on account

Buying on account is now the most popular payment method in Germany. At Shopify Payments, this is possible with Klarna. This means that all customers who prefer Klarna and purchase on account are already satisfied.

Instant bank transfer

Payment via Sofortüberweisung, which has also been part of Klarna since 2014, is also very popular in Germany. Customers use their online banking access data for this.

Apple Pay and Google Pay

These two payment providers are also gaining ground in the D-A-CH region. Although Apple Pay and Google Pay are currently hardly used, the potential user numbers are extremely high due to the simple integration into every smartphone. The provision of these payment gateways is likely to appeal to a younger target group in particular.

Amazon Pay

Amazon may well be seen as a competitor, but the advantage of accepting this payment method is obvious. Many people already have an Amazon account. Many people find registering in another online store a hurdle, but Amazon Pay takes this off their hands. This allows customers to make a purchase in your online store quickly and without any hurdles.

Meta Pay

As with Amazon Pay, it is more convenient for many customers to use their existing Meta (Facebook & Instagram) account for payment.

Credit card payment

Credit card payments are rarely used in Germany, but are all the more popular in Austria. Shopify Payments supports: VISA, MasterCard, Maestro and American Express

Bank transfer with EPS

Transfers via EPS are also popular in Austria. These are similar to instant transfers. Buyers make their payment using their own online banking access data, but no sensitive data is forwarded.

Store Pay

Store Pay is Shopify's in-house payment method. With Shop Pay, a lot of emphasis is placed on simple and accelerated payment. Payment information such as email address and shipping information only needs to be entered once, which leads to a better checkout experience. Store Pay also supports the express checkout function, which allows customers to buy a product directly with just a few clicks.

In which countries is Shopify Payments available?

Shopify Payments is currently available in the following countries:

- - Australia

- - Austria

- - Belgium

- - Canada

- - Czech Republic

- - Denmark

- - Finland

- - France

- - Germany

- - Hong Kong (Special Administrative Region)

- - Ireland

- - Italy

- - Japan

- - Netherlands

- - New Zealand

- - Portugal

- - Romania

- - Singapore

- - Spain

- - Sweden

- - Switzerland

- - United Kingdom

- - United States

Advantages of Shopify Payments

Of course, Shopify benefits considerably if you use Shopify Payments for your store. For this reason, Shopify tries to make its payment gateway as attractive as possible. That's why Shopify Payments offers you a number of advantages, each of which I'll go into in more detail.

Simple setup

The payment methods are easy to set up with Shopify Payments and are ready to use in just a few minutes. This saves you having to set up and verify different business accounts and you don't have to create a link.

Compatibility with other payment providers

Shopify Payments can be operated simultaneously with other payment gateways such as Paypal to give the customer maximum choice.

No additional transaction fees

The best argument for Shopify Payments. Activation saves you the transaction fees charged by Shopify.

Shopify charges two different types of fees. The first consists of transaction fees that you pay to external providers. For example, companies such as VISA or PayPal charge fees for processing payment transactions. These fees are borne by you as the merchant. The fees vary depending on the payment method and Shopify plan.

In addition, there are other fees that Shopify charges you. These also vary, but can be avoided. Because as soon as you activate Shopify Payments in your store, the additional fees that Shopify charges are completely eliminated, regardless of the payment method that your customers choose. For this reason, I recommend every Shopify merchant to activate Shopify Payments.

Checkout process in your own store

The checkout process with Shopify Payments takes place entirely in your own store. This eliminates potential hurdles such as additional login procedures on third-party sites, which can have a positive effect on the conversion rate.

Security and fraud protection

Shopify Payments guarantees the highest security standards. All payment data is fully encrypted and PCI-compliant. In addition, Shopify Payments offers fraud analysis that detects criminal activity. For this purpose, AVS checks, card verification numbers and IP addresses are analyzed and a detailed report is created for each order.

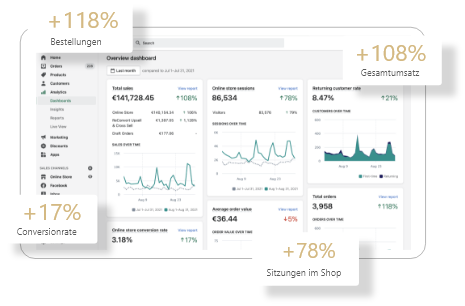

Overview in the Shopify Payments Dashboard

In the Shopify Payments dashboard, you have all transactions at a glance. This allows you to manage and view all payments centrally with a complete overview.

The perfect solution for international online stores

Shopify Payments supports over 130 currencies and is therefore, in my opinion, indispensable for international Shopify stores.

Ideal interface to physical stores

Shopify Payments also makes your life easier when combined with a physical store. Shopify POS allows you to seamlessly connect your physical store with your Shopify Shop. This means you can easily accept payments in-store or at trade fairs.

Express check-out

With Shopify Payments, you can easily integrate the express checkout options of Apple Pay, Google Pay and Shop Pay to provide your customers with particularly convenient checkouts. This function actively reduces the number of abandoned purchases.

Disadvantages of Shopify Payments

Nothing comes with advantages, so Shopify Payments also has disadvantages. However, I can already say in advance that the elimination of fees and compatibility with other payment gateways are enough reasons to recommend Shopify Payments to almost every Shopify merchant. Nevertheless, here is a brief overview of the disadvantages for you.

Chargeback fees

In Germany, a fee of €15 is charged for each chargeback. This can add up to high costs in some cases. These chargebacks can occur, for example, when credit card payments are canceled. However, these do not normally occur more frequently.

Frozen contributions

Under certain circumstances, suspicious activity may be checked. Shopify Payments can temporarily freeze your funds for this purpose. If you are affected by this, it is advisable to contact Shopify Support directly, who can help you to resolve your problem quickly.

Click here for Shopify support

Shopify Payments setup, this is how it works

What do I need to consider before setting up Shopify Payments?

- - First of all, you should make sure that your bank account meets Shopify's requirements.

- - The account must be a current account that accepts the local currency of your region.

- - Shopify does not support savings accounts or foreign currency accounts.

- - A German account must therefore be held in euros, support SEPA transfers and have a valid IBAN.

Activate Shopify Payments

- - In the "Admin area" of Shopify, go to "Settings" and then Payments.

- - If you have not yet set up a credit card provider, click on "Complete account setup" in the Shopify Payments section. Alternatively, click on "Activate Shopify Payments".

- - You must then fill in all the required business details correctly.

- - Now you need to enter your personal details from your ID card and enter your IBAN.

- - Check once again that you have filled in all the details correctly. You can then complete the setup.

Shopify Payments should then be set up successfully and your customers can now shop using the most common payment methods.

Which payment methods should you offer in addition to Shopify Payments in your Shopify Shop?

Since Shopify Payments saves you transaction fees regardless of the payment method and 59% of customers are likely to bounce if they cannot find an acceptable payment method in your store, it is particularly important to choose the right payment gateway. In addition to Shopify Payments, I would recommend the following providers:

PayPal

PayPal is one of the most popular payment methods in Germany. That's why it should not be missing in any Shopify store. To enable your customers to use PayPal, you must first connect the payment method to your store. After that, customers can use PayPal in your store as usual.

Prepayment/bank transfer

Although this relic from the past is hardly used nowadays, it can still be a useful addition depending on the target group. Setting up bank transfers in your Shopify store is relatively simple. You can find the option in your Shopify settings under Payments. A small drawback is that with this payment method you have to manually mark the order as paid.

Payment on collection

If you also want to enable your customers to pick up the products on site, this payment function is ideal. You can also easily set up payment on collection in your Shopify settings. Once the customer has paid for the product on site, you also need to manually mark the order as paid.

SEPA Direct Debit

Direct debit is particularly suitable for subscriptions. With this method, the customer authorizes you to debit the amount directly from their account. Unfortunately, this payment method is not directly supported by Shopify. However, you can use external payment service providers that offer SEPA. I recommend the provider Mollie for this. The only disadvantage here is that users are redirected to an external payment page for the checkout, just like with PayPal.

Klarna or Adyen

For large volumes, it may make sense to use Klarna or Adyen as a payment gateway. To do this, you need to set up the app outside of Shopify Payments. So if you sell large volumes, you can consider this strategy. In the end, the profitability depends on the individual fees, so it varies from merchant to merchant.

Bitcoin and other cryptocurrencies

Cryptocurrencies are a polarizing topic. While many are rather sceptical about the entire industry, others have already recognized its use case and are using it. Various third-party apps want to enable payment with cryptocurrencies in Shopify stores, but the entire industry is still in the starting blocks. Personally, I would still advise against implementing it at the moment, but it could be an interesting alternative to traditional payment methods in the future.

Conclusion on Shopify Payments

Shopify makes our lives easier with Shopify Payments. With a collection of popular payment methods, we can save ourselves the complicated setup of many service providers. The decisive factor for an unreserved recommendation on my part, however, is above all the possibility of saving the extra Shopify fees that Shopify would otherwise charge for third-party solutions. Since Shopify Payments does not exclude the use of alternative gateways, these can also be set up as required. As a result, Shopify Payments shines with its advantages, while the disadvantages are negligible. As a Shopify agency, we can advise and support you on all topics in the Shopify Space. Feel free to contact us for a free introductory meeting.

Shopify Payments FAQ

Which Shopify Payments are available?

Shopify offers a variety of payment options via the Shopify Payments system, including Klarna purchase on account, credit and debit cards, Apple Pay, Google Pay, Meta Pay, Shop Pay, Sofortüberweisung and bank transfer with EPS.

How do I activate Shopify Payments?

- - Log in to your Shopify dashboard.

- - Go to Settings ⇨ Payments.

- - Click on "Activate Shopify Payments".

- - Enter your business details and submit additional documents if required.

- - After verification by Shopify, Shopify Payments is activated.

What are the fees for using Shopify Payments?

The fees charged by Shopify do not apply if you decide to use Shopify Payments. However, the fees of the respective payment gateways still apply.

Does Shopify Payments work in Germany?

Yes, Shopify Payments works in Germany. Germany is one of the countries where Shopify Payments is supported.

In which countries are Shopify Payments offered?

Shopify Payments is now officially available in 23 countries including: Australia, Austria, Belgium, Canada, Czech Republic, Denmark, Finland, France, Germany, Hong Kong, Ireland, Italy, Japan, Netherlands, New Zealand, Portugal, Romania, Singapore, Spain, Sweden, Switzerland, United Kingdom and the United States.